Monday, December 23, 2013

Wednesday, December 4, 2013

Where Prices Are Headed Over The Next 5 Years

- Home values will appreciate by 4.3% in 2014.

- The average annual appreciation will be 4.2% over the next 5 years

- The cumulative appreciation will be 28% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 16.8% by 2018.

Friday, November 1, 2013

Monday, October 21, 2013

Four House Selling Myths

and found that many will only net you between 60 and 80 percent of what you paid for them. Even the most desirable renovation like a bathroom or kitchen remodel are basically break-even upgrades. Rather than dump a bunch of money on a home you’re trying to sell, stick to small improvements like a fresh coat of paint or some basic lawn care, and leave the major renovations to the new homeowners.

and found that many will only net you between 60 and 80 percent of what you paid for them. Even the most desirable renovation like a bathroom or kitchen remodel are basically break-even upgrades. Rather than dump a bunch of money on a home you’re trying to sell, stick to small improvements like a fresh coat of paint or some basic lawn care, and leave the major renovations to the new homeowners. , if not more so. So if you’re planning on selling your home, don’t wait around for the right season; get it on the market now.

, if not more so. So if you’re planning on selling your home, don’t wait around for the right season; get it on the market now. Wednesday, October 2, 2013

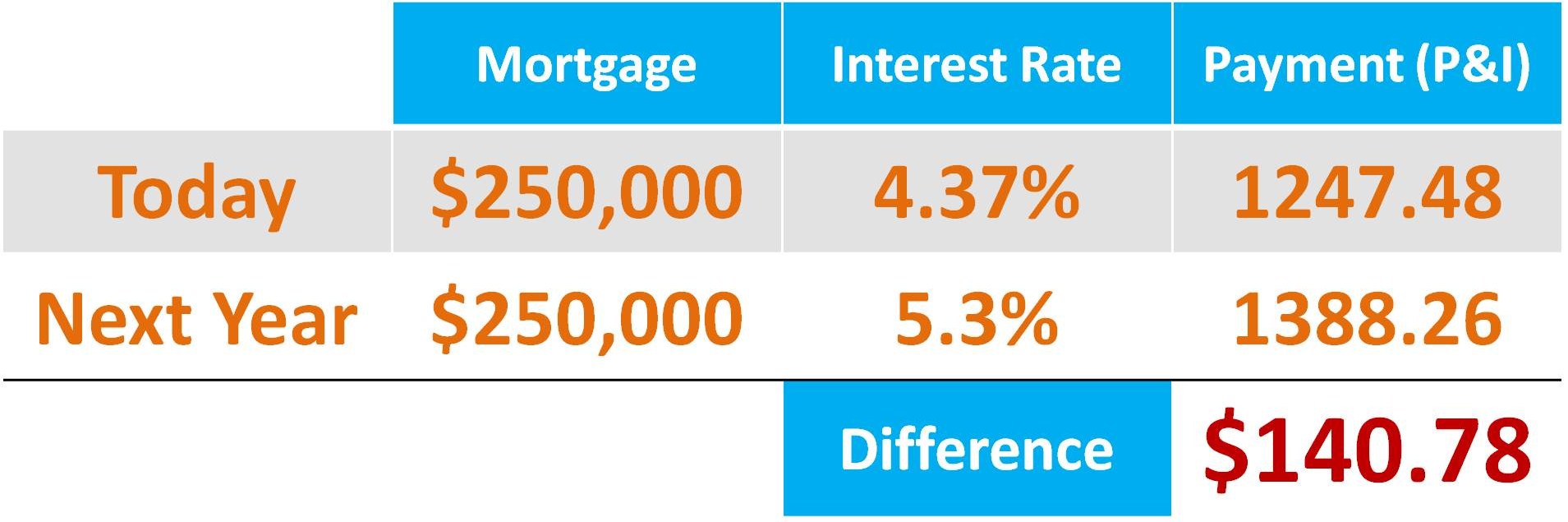

Buyers: Window of Opportunity Still Open

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).

The Fed recently announced they would continue their current pace of purchasing bonds until the economy was stronger. This bond purchasing program is the reason that mortgage interest rates are at historic lows. Rates began to increase over the last several months just on the anticipation that the Fed would announce that they would be reducing the level of bond purchases last month. When that didn’t happen, rates actually decreased (4.50 to 4.37).Friday, September 13, 2013

Fewer Foreclosed Homes to Buy, Investors Move to Standard Sales

Few realized then that investors would respond with overwhelming force: Big and small players have injected billions into the market, racing one another to buy up foreclosed homes in post-crash markets. Wall Street launched a sophisticated industry based on buying and renting out homes in bulk. The suburbs of Southern California, Arizona and Nevada saw a virtual land run, creating frenzied demand that has pushed up prices more than 20% in a year.

Now the foreclosed homes in those markets are almost gone — yet investors have kept buying, competing with individual buyers in standard sales.

The number of so-called absentee buyers, usually cash investors, has dropped slightly in Southern California since hitting a record in January. But they still account for more than 1 in 4 home purchases in the region. And just 8% of those deals were on foreclosed homes in June, compared with 25% a year earlier and a peak of 55% in February 2009.

"Everybody and their dog is an investor," said Dick Caley, a Long Beach real estate agent. "It has gotten to the point where I do not even return the call."

As it turned out, housing investors needed neither the prodding of the Federal Reserve nor the bulk foreclosure sales from Fannie Mae, which never materialized beyond the pilot phase. The single-family rental industry now has several major players in multiple markets, with some recently created companies trading publicly.

The mix of investors and their strategies are shifting, with large financial firms starting to pull back and smaller players moving in, looking to buy, fix and flip homes for a quick profit. But rapid price increases are making it harder for people to afford a house and qualify for a home loan.

And the short-term mentality worries some economists.

"Flippers are selling to other flippers, who are selling to other flippers, until there is nobody to flip the home to," said John Burns, a housing industry consultant in Irvine. "And that is when you have a big downturn."

The investor interest in regular home sales means everyday buyers are more likely to pay a premium for a house. But shoppers could benefit from a retreat by the institutional, buy-and-hold investors, who tend to compete more directly with regular buyers and pay higher prices than home flippers. Flippers need to buy homes below market value; investors planning to rent and hold the home can bank on long-term price appreciation.

"The buy-and-hold investors are the ones who really pose a threat to first-time buyers," said Sean O'Toole, chief executive of data firm PropertyRadar. "The buy-and-hold investor is leaving, and the flipper is in right now."

Flipper Jonathan Zadok still sees upside in the suburbs despite the lack of foreclosures. Zadok quit his job as an equity trader three years ago and plunged into the business of buying, renovating and reselling foreclosed homes in the Inland Empire. With the foreclosed bargains nearly gone, Zadok has started shopping in more established neighborhoods and buying more expensive homes, which carry more risk but add profit potential.

For now the work is exciting and interesting enough for Zadok to keep at it, he said.

"I love it, it's nonstop," he said. "Trying to find that next deal, selling that next house."

U.S. corporations, private equity firms and foreign investors remain a driving force in real estate, said Anthony Sanders, a professor of real estate finance atGeorge Mason University. Those investors have been lured to U.S. real estate because financing costs have been so low.

But that could quickly change.

"This is not your father's housing recovery. In other words, this is not household-related; this is more of an investor recovery," Sanders said. "If interest rates keep rising, we will inevitably see the stock market pop, meaning go down, and with it will probably come the housing market."

Norris Group in Riverside — which holds regular, sold-out symposiums on real estate investing — begs to differ. The firm's president, Bruce Norris, recently told a packed room of investors at the DoubleTree hotel in Ontario that home prices had plenty of room to run, and that investing in California real estate was still a good bet. Housing has moved quickly from bottom to boom, but Norris believes prices in California will keep climbing because housing remains affordable to a large percentage of buyers.

Aaron Norris, marketing director for the group, said investors were doing more dramatic renovations to unlock the value in homes. Rather than cosmetic upgrades, they are adding square footage and in some cases even looking to buy land for new construction.

With the continuing shortage of home supply, investors are getting even more aggressive, knocking on doors and sending out mailings to attract sellers, Norris said.

"We're purchasing from people directly," Norris said. "We've been teaching people for the last few years this is where the deals would come from."

There are other signs of the shift in investors' focus. O'Toole recently expanded his company and changed its name from ForeclosureRadar to PropertyRadar.

His firm started out as a data service marketed directly at auction investors, those tracking sales on the courthouse steps. PropertyRadar has expanded features for real estate agents and investors hoping to find properties before they hit the market.

Experienced flippers say the increased competition is forcing them to change tactics.

Brian Coomans, owner of investment company GGB Properties Inc. in Long Beach, said he considered himself a "production investor" when he first started, finding cheaply priced foreclosed homes and fixing them up for a quick profit. But that's an easy business to enter, and Coomans soon faced a lot of competition. So, like Zadok, he has been hunting for select deals in pricier neighborhoods, buying homes that have just been inherited, for instance.

He tries to forge tight relationships with real estate agents to get an inside track on sales.

"The margins are still the same, but you have to hunt harder for them and you can't count on a certain volume of deals," Coomans said.

Zadok remembers 2009, when there were lots of properties and not a lot of buyers. The next year he hopped into the business, choosing San Bernardino because of the high number of foreclosures there.

Homes were boarded up, lawns were overgrown or dying, and pride in homeownership was gone, he recalled. Those days are over, and now he sees a short window of time left to make money.

"I know I am not going to be doing this forever," he said. "I have maybe a one-year window, a two-year window to be flipping homes like this."

Sunday, August 25, 2013

Wednesday, August 21, 2013

House Pricing is Still about Supply and Demand

1.) Dramatic year-over-year inventory declines have evaporated.

2.) Inventory declines decrease in local markets.

The recovery is entering a new phase where inventory shortfalls are no longer the driving force behind changes in housing prices in many markets. Larger inventories, especially in the hotter markets that experienced rapid price increases in the spring, are expanding buyers’ choices and helping to moderate price increases.

Thursday, August 15, 2013

3 Reasons to Buy that House NOW!

Friday, August 2, 2013

Friday, July 19, 2013

Home Price Rebound Has Look of a Boom

The median home price in Southern California surged a stunning 28% in June compared with a year earlier — outpacing any month during last decade's housing bubble. The gain puts the median at $385,000, up from $300,000 last June.

Some experts warn that prices, driven by short supply, should cool off soon. Investors who have flooded the region with cash purchases will probably retreat, they say, as a fresh supply of sellers and builders moves in. But others see nothing but higher prices ahead, with supply staying tight and buyers scrambling to close deals before the window of affordability slams shut.

Syd Leibovitch, founder and president of Rodeo Realty in Beverly Hills, said he expects prices to double from their bottom last year.

"You have a lot of room to run," Leibovitch said. "Because historically, they always double in these cycles, and then they drop back a bit."

For now, many home shoppers are tendering ever-higher offers in cutthroat bidding wars.

"They are following the fiddler," said real estate agent Amber Dolle. "They are hearing that there is this huge panic to get into a home."

The Southland's recovery began last April, when the median home price rose 3.6% year-over-year, to hit $290,000. The recent increases now represent gains on top of last year's increases, rather than rebounds from historic lows. And yet the percentages have continued to grow since crossing the 20% threshold in January of this year.

June's increase is the highest percentage gain recorded by DataQuick since the firm started measuring year-over-year price changes in 1989. The current median is, however, still well below the peak of $505,000 reached in 2007, just before the crash.

The reality for buyers is financially and emotionally draining. Jessica Wilde and her husband Guy wrote a heartfelt letter to the seller of a Covina house, pleading the owner to choose them over an investor. They ultimately won the bidding war — if you define winning as paying $411,000 for a home listed at $360,000.

"I saw it one time for 30 minutes," Wilde said. "When would you ever buy something that expensive, and see it for 30 minutes?"

Such scenarios are giving rise to increasingly optimistic predictions of future home price gains. Hedge fund titan John Paulson — who made a fortune betting against the housing market before the crash — now says he's bullish on housing.

"It's more or less seven years — seven years up, seven years down — very similar to the Bible," Paulson said Wednesday during a conference presented byCNBC and Institutional Investor. "I think we are just at the beginning of the recovery. I would expect this recovery to continue for at least the next four, possibly seven, years."

Southland buyers purchased 21,608 new and resale houses and condos last month, a 2.1% drop from June of last year, and a 6.2% decline from May, an indicator of tight supply. That's the first time sales have declined over the year since September.

Absentee buyers — usually investors — continue to see bargains even with the rapid rise in prices. Their purchases accounted for 28.7% of homes sold, DataQuick reported. Cash buyers made up 30.2%. Both those percentages were declines from May, but still far above historical averages.

Glenn Kelman, chief executive of online brokerage Redfin.com, is in the camp of those who predict the market will chill during the second half of the year.

"The smart money has left the building," he said. "There is not as much investor activity, as the investors have really tired of competing with regular home buyers. And what we have seen in the last few weeks has been a significant slowdown in demand."

Richard Green, director of USC's Lusk Center for Real Estate, said buying a home is no longer a "slam dunk," given the rise in prices and interest rates, which have jumped a full percentage point since May to about 4.5%. Potential home buyers aren't seeing their personal incomes grow enough to support such eye-popping home price gains, Green said.

"This has just got to stop pretty soon, and I think fall is probably when it will happen," Green said. "People shouldn't expect this to continue for very long. If that is the basis they are buying something — they shouldn't."

Stuart Gabriel, director of UCLA's Ziman Center for Real Estate, dismissed any notion that the market is headed for another bubble.

"It's a striking number, there is no question about it," Gabriel said. But "I don't believe our situation is in any shape or form similar to the situation we faced in the mid-2000s."

A mismatch of supply and demand underlies the recent spectacular home price gains, he said. During the recent slowdown, builders brought new construction to its lowest level since the Great Depression. Then the rapid turnaround caught builders off-guard — and they haven't cranked up production to anywhere near normal levels.

"Builders are still not putting up enough homes," IHS Global Insight economist Patrick Newport wrote Wednesday morning following news that new home starts declined 10% in June. "Far from it."

Supply remains constrained because many people who own their own homes still owe more on their homes than they're worth. Moreover, sales of foreclosed homes have plummeted to just 9% of the market — down from nearly half of sales in February 2009 — eradicating a source of homes that many experts wrongly predicted would glut the market for years.

Demand for homes remains robust. The recent uptick in interest rates has probably spurred more buyers to close deals, fearing rates will rise more.

Investor demand has waned slightly, but still remains strong, particularly among smaller players dealing in a handful of homes. Further driving demand: A pipeline of people who lost their homes three years ago are reentering the market because they can again qualify for mortgages.

Dolle, the agent specializing in the San Fernando Valley, said she has seen the frenzy ease a bit recently. But multiple offers are still common.

"Everyone is going through this," she said. "Every single buyer I have worked with since probably December has had to pay at asking or above asking."

Tuesday, July 2, 2013

House Sale Price: List It Right from the Beginning

The Research

Are there any negative effects from changing the listing price of a property? This question haunts Brokers/Agents as well as sellers of property every day. At present, there does not seem to be a consensus answer to this question within the professional real estate community. Fortunately, this question was scientifically investigated by John R. Knight. Unfortunately, few know the results of Professor Knight’s research.

In Knight, the impact of changing a property’s listing price is investigated. Additionally, the types of property that are most likely to experience a price change are also estimated. The findings from this research indicate that, on average, properties which experience a listing price change take longer to sell and suffer a price discount greater than similar properties. Furthermore, bigger price changes are found to experience even longer marketing times and greater price discounts. Finally, as for which properties are most likely to experience a price change, Knight finds that the greater the initial markup; the higher the likelihood that any given property will experience a listing price change.

Implications for Practice

Sellers as well as Brokers/Agents should therefore be aware of the critical necessity of getting the price correct from the start. Sellers wanting to over list will ultimately take longer to sell and will sell their property for less, on average, according to Knight. Brokers/Agents’ desire to take a listing and get the price right later will ultimately lead to their working harder according to Knight, and they are not doing their sellers any favors. Thus, an initial and detailed analysis of the proper price is much more critical than many originally thought.Interestingly, I have found in my own research that the direction (up or down) of the listing price change does not matter. A listing price increase and decrease both lead to similar results found in Knight’s work – longer marketing times and lower prices. Therefore, get the price right from the beginning. It is best for all. Read more...

Tuesday, June 4, 2013

When To Buy a House? RIGHT NOW!

After witnessing the housing bubble ‘pop’ just a few years ago, many would be buyers may be hesitant to pull the trigger. Today, we want to explain that the greatest risk a buyer can take right now is actually waiting to buy a home.

We realize that every purchaser wants to be able to get the best deal. They want a great price and the lowest mortgage interest rate possible because those two items together will determine the monthly cost their family will pay. Let’s look at each one:

Are home prices rising?

Just last week, the Case Shiller Pricing Index was released. The index revealed that U.S. home prices increased by 10.2% over the last twelve months. Last month, the Home Price Expectation Survey was released predicting that home values would increase by at least an additional 3.5% for each of the next five years.If you were waiting for the absolute bottom of the home price declines, you already missed it.

Are interest rates rising?

According to Freddie Mac’s Weekly Primary Mortgage Market Survey, the 30 year mortgage rate shot up to 3.81% last week – the highest level in over a year. This is an increase of a half of a percentage point in the last six months. And the Mortgage Bankers Association, Fannie Mae and the National Association of Realtors all predict that rates will continue rise over the next eighteen months.Conclusion

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings. Read more...Wednesday, May 22, 2013

House Prices Projected to Increase

Experts have projected that U.S. home prices will appreciate by 5.4% in 2013. If we assume that prices will rise about the same 5% over the next twelve months, here is the difference a buyer will pay if they wait a year.

Read more...

Saturday, May 11, 2013

Wednesday, April 24, 2013

Saturday, April 13, 2013

5570 Southwind Lane - Just Listed!! $779,000 - Yorba Linda, CA

Read more...

Wednesday, April 10, 2013

3 Reasons to Sell Your House Today!

This week, we are going to look at the three reasons to sell your house now instead of waiting: demand is strong, supply is low and new construction will soon be your competition. – The KCM Crew

Part III – New Construction Will Soon Be Your Competition

Over the last several years, most homeowners selling their home did not have to compete with a new construction project around the block. As the market is recovering, more and more builders are jumping back in. As an example, the National Association of Realtors revealed, relative to last year, year-to-date new home sales are up 19%.These ‘shiny’ new homes will again become competition as they can be an attractive alternative to many of today’s home purchasers.

Here are the numbers regarding new construction about to come to market from the Census Bureau:

BUILDING PERMITS

- Single-family authorizations in February were at a rate of 600,000.

- This is 25.5% above February 2012.

HOUSING UNDER CONSTRUCTION

- Single-family housing starts in February were at a rate of 618,000.

- This is 18.5% above February 2012.

HOUSING COMPLETIONS

- Single-family housing completions in February were at a rate of 574,000.

- This is 32.9% above February 2012.

Thursday, April 4, 2013

Should Your Buyers Increase Their Offer?

Limited inventory and a very strong demand for housing has created an environment where bidding wars are commonplace in today’s real estate market. Homes priced properly are getting multiple offers within a short time of coming to market. This brings about a dilemma for the agent: How should they advise their client who is about to make an offer when other offers will also be presented?

Over the last several years, there wasn’t any pressure on the buyer to adjust their offer for three reasons:

- There were plenty of homes for sale

- Prices were falling

- Mortgage interest rates were falling

HOUSING INVENTORY

A normal real estate market has between 5-6 months worth of inventory. Over the last several years, the inventory of homes for sale had skyrocketed to 10 months. Most buyers in almost any price range had a multitude of houses to choose from. Today, the national month’s supply of inventory has fallen below five months. In many markets, there is not enough housing inventory to satisfy the current demand.Conclusion: If the buyer loses the house they are bidding on, there is no guarantee they will find a similar home anytime soon.

HOME PRICES

Becausemof the limited inventory, home prices are again appreciating. The Case Shiller Pricing Index revealed that house prices rose by 6.8% in 2012. Experts are projecting home prices to increase by 5% to 8% in 2013.Conclusion: If the buyer doesn’t get this house, there is a good likelihood that a similar home will cost more in the future.

MORTGAGE RATES

The ‘cost’ of a home to a buyer is determined by the price of the house and the expense associated with the financing. Mortgage rates are projected to inch up in 2013. In a recent forecast, the Mortgage Bankers Association predicted that rates could climb as high as 4.3% by the end of the year.Conclusion: If interest rates do inch up, the ‘cost’ of the next home could be impacted significantly.

Bottom Line

If a buyer truly loves the house they are bidding on, it probably makes sense to raise their bid now instead of waiting for another dream house to appear. Read more...Wednesday, March 27, 2013

JUST LISTED - 21170 Via Lugo - Yorba Linda - $799,000-$849,000

NEW ON MARKET!!Model Perfect Travis Ranch Home in CUL-DE-SAC WITH ROOF TOP VIEW! Beautifully upgraded! Front Entry opens to a beautiful Family room, Cathedral ceilings with separate formal dining room. Scraped ceilings, Designer molding,crown molding Lauzon wood floors, Plush Carpet, Tile flooring and Simon-ton Dual Pane Windows Throughout Home. New Stainless Steel Appliances, Granite Counter Top, large granite kitchen island, Custom travertine Back splash custom maple cabinets, beautiful custom kitchen ceiling with lighting & large new patio window are part of a kitchen you will not want to leave! Family room has surround sound, Fireplace refaced with stack stone and new mantel! Inside Laundry,remodeled full bath & guest room downstairs!! Second story which has three bedrooms, including a beautiful Master Bedroom and two upgraded bathrooms! LARGE Backyard Is Perfect For Entertaining!! Concrete Patio with large newly painted cover,outside speakers,custom lighting, retreat area off family room formal dining area, beautifully manicured lawn and shrubbery and large side storage area. This Home Has New! Interior & Exterior Paint, 3 car garage, is Close To Award Winning Schools, parks, Dining, Shopping, Freeways and Toll Roads.

21170 Via Lugo Detailed Listing Report

Read more...

Monday, March 25, 2013

Tuesday, March 5, 2013

Future House Values? Simple as Supply and Demand

For some time now, we have attempted to shed light on the fact that pricing in today’s real estate market, as it is in the markets for every other sale able item, will be determined by the concept of ‘supply and demand’.

“The relationship between supply and demand determines the price of a commodity. This relationship is thought to be the driving force in a free market.”

- 1-4 months supply creates a sellers’ market where there are not enough homes to satisfy buyer demand. Appreciation is guaranteed.

- 5-6 months supply creates a balanced market. Historically home values appreciate at a rate a little greater than inflation.

- 7-8 months supply creates a buyers’ market where the number of homes for sale exceeds the demand. Depreciation follows.

What is happening across the country right now?

- According to NAR’s latest Existing Homes Sales Report, raw unsold inventory is at the lowest level since December 1999 when there were 1.71 million homes on the market.

- According to this month’s Pending Sales Report from NAR, houses going into contract reached levels last seen in April 2010 which was the month the Home Buyers’ Tax Credit expired.

Monday, February 25, 2013

Friday, February 8, 2013

Short Sales – 10 Common Myths Busted

Short Sales – 10 Common Myths Busted

It’s likely you've heard the term “short sale” thrown around quite a bit. What exactly is a short sale?

A short sale is when a bank agrees to accept less than the total amount owed on a mortgage to avoid having to foreclose on the property. This is not a new practice; banks have been doing short sales for years. Only recently, due to the current state of the housing market and economy, has this process become a part of the public consciousness.To be eligible for a short sale you first have to qualify!

To qualify for a short sale:

- Your house must be worth less than you owe on it.

- You must be able to prove that you are the victim of a true financial hardship, such as a decrease in wages, job loss, or medical condition that has altered your ability to make the same income as when the loan was originated. Divorce, estate situations, etc… also qualify. There are some exceptions to hardship now, but for the most part the bank or investor will need to verify some type of hardship.

1.) If you let your home go to foreclosure you are done with the situation and you can walk away with a clean slate. The reality is that this couldn’t be any farther from the truth in most situations. You could end up with an IRS tax liability and still owing the bank money. Let me explain. Please keep in mind that if your property does go into foreclosure you may be liable for the difference of what is owed on the property versus what is sells for at auction, in the form of a deficiency balance! Please note this is state specific and in most states you will be liable for the shortfall, but in some states the bank may not always be able to pursue the debt. Check your state law as it varies widely from state to state.

Here is an example of how a deficiency balance works:

If you owe $200,000 on the property and it sells at auction for $150,000, you could be liable for the $50,000 difference if your state law allows it.

Not only could you be liable for the difference to the bank, but in some situations you could also be liable to the IRS! Although there are exemptions (mostly for principal residences) under the Mortgage Debt Forgiveness Act, there are times when you could be taxed on both a short sale and a foreclosure, even in a principal residence situation. Since the tax code on this is a little complicated and I am not a CPA, I advise always talking to a CPA when in this situation as you are weighing your options. Banks and the IRS can go as far as attaching your wages. Not to mention if you let your home go to foreclosure you will have that on your credit, as well.

Guess What? A short sale can alleviate your liability to the bank, in most situations. There are also exceptions to this, but in most cases banks are releasing homeowners from the deficiency balance on a short sale.

2.) There are no options to avoid foreclosure. Now more than ever, there are options to avoid foreclosure. Besides a short sale, loan modifications along with deed in lieu are also examples of the many options. In most cases (but not all) a short sale is the best option. Either way, there are more options today than there have ever been to avoid foreclosure.

3.) Banks do not want to participate in a short sale, or, it is too hard to qualify for a short sale. Banks would rather perform a short sale than a foreclosure any day. A foreclosure takes a long time and creates a huge expense for the banks; a short sale saves both time and money. In working with some of the biggest lenders and servicers in the country they have told me that on average they net 17-25% more on a short sale than on a foreclosure. A testament to this is the financial incentives now being offered by banks, and how much the entire process has recently changed to try and streamline the process for all parties. Banks more than ever welcome short sales. Qualifying for a short sale is easier than you think, you need to have a true financial hardship, or a change in your finances and your house has to be worth less than what you owe on it. Not only do consumers, but banks also now have government incentives to participate in short sales.

4.) Short sales are not that common. At this present time, short sales range from 10-50 % of sales in various markets and it is predicted that in 2013 we will have more short sales than any other year, to date. One of the biggest reasons is that MHA(Making Home Affordable expires December 2013). Many of the Government incentives like HAFA, will expire the end of this year. Due to economic changes in the last few years, this is something that is affecting millions of Americans. Short sales are in every market, and are not just limited to any particular income class. This has affected everyone from all facets of life. A short sale should be looked at as a helpful tool, not a negative stigma.That is why the government is offering programs that actually pay consumers to participate in short sales. It is not just affecting one community; it is affecting communities and consumers across the nation.

5.) The short sale process is too difficult and they often get denied. Though the short sale process is time consuming; it is not as difficult as the media would have you believe. The problem is that most short sales are denied because of a misunderstanding of the process. It is true that if the short sale process is not followed correctly there is a good chance of getting denied. An experienced agent knows how to avoid this. Short sales require a lot of experience, and a special skill set. If you are looking to go the option of a short sale make sure your agent is skilled and experienced in this area.

6.) Short sales will cost me money out of pocket. A short sale should not cost you any out of pocket money. In fact, you could get between $3000-up to $30,000 to participate in a short sale. In many ways, a short sale may put you in a better financial position than prior to the short sale. Almost every short sale program now has some type of financial incentive for the home owner, as long as it is a principal residence, and we are even seeing relocation money being paid on some investment/second homes. As a seller of a property you should never have to pay for any short sale cost upfront to any professional service. Realtors charge a commission that is paid for by the bank. In most communities there are also non-profits and HUD counselors who can help you with foreclosure prevention options for free. The only potential cost you could incur is if the bank would not release you from a deficiency balance in the short sale, which is happening less and less now.

7.) If I am behind on my payments, I can perform a short sale any time. The farther you get behind on your payments, the harder it is to get a short sale approved. The closer a property gets to a foreclosure the harder it is to convince the bank to perform a short sale. As they get closer to a foreclosure sale more money is spent, thus deterring them from doing a short sale. If you think you need to perform a short sale, time is of the essence; the sooner you start the process, the better. Waiting too long can trigger the ramifications of a foreclosure, losing the ability to do a short sale as a viable option.

8.) I have already been sent a foreclosure notice so I can’t perform a short sale. For the most part just because you received a foreclosure notice or notice of default it does not mean that you do not have time to perform a short sale. The timeline and specifics do vary from state to state, but having done short sales all over the country, I have seen banks postpone a foreclosure to work a short sale option as close as 30 days prior to the scheduled foreclosure auction, but the longer you wait the less chance you have. If you have received a legal foreclosure notice, please reach out to a professional right away. The longer you wait, and the closer you get to foreclosure, the fewer options you have. If you have received a notice to foreclose this means the bank is filing paperwork and starting the process to take legal action to repossess the house. You still have time at this point to prevent foreclosure, but do not hesitate! The closer you get to the foreclosure date the harder it becomes to negotiate with the bank for whichever option you choose.

9.) I was denied for a loan modification, so I know I will get denied for a short sale. Short sales and loan modifications are handled by two separate departments at the bank. These processes are totally different in approval and denial. If you got denied for a modification you can still apply for a short sale; in some cases you can get a short sale approved faster than a loan modification, as some loan modifications are denied because they cannot reduce the loan low enough based on the consumers income.

10.) If I go through a short sale I cannot buy another house for a long time. The time to buy another house depends on your entire credit picture and can vary from 2-3 years. Fannie and Freddie just came out November first and said a homeowner may be eligible two years after a short sale to repurchase. There are even a few FHA programs that allow for a purchase sooner than that, but the guidelines are fairly strict. Some regional and local banks will finance 16-18 months after a short sale, but the interest rate will more than likely be higher than one of the national chains, and this is based on their specific under writing guidelines.

These are just a few of the common myths surrounding short sales and foreclosure. With the options available today, no homeowner should ever have to go through foreclosure, and hopefully this information can help a few more homeowners think twice before walking away from their home not realizing the possible long term ramifications a foreclosure can have.

.png)